The average NFL salary is $2.8 million, however The American Institute of Bankruptcy reports that 16% of NFL players file for bankruptcy within 12 years after retiring! Despite wealth, fame, and power, how do they end up losing everything? Here’s what you can learn from their mistakes.

Mistake #1: Choosing the Wrong Financial Advisor

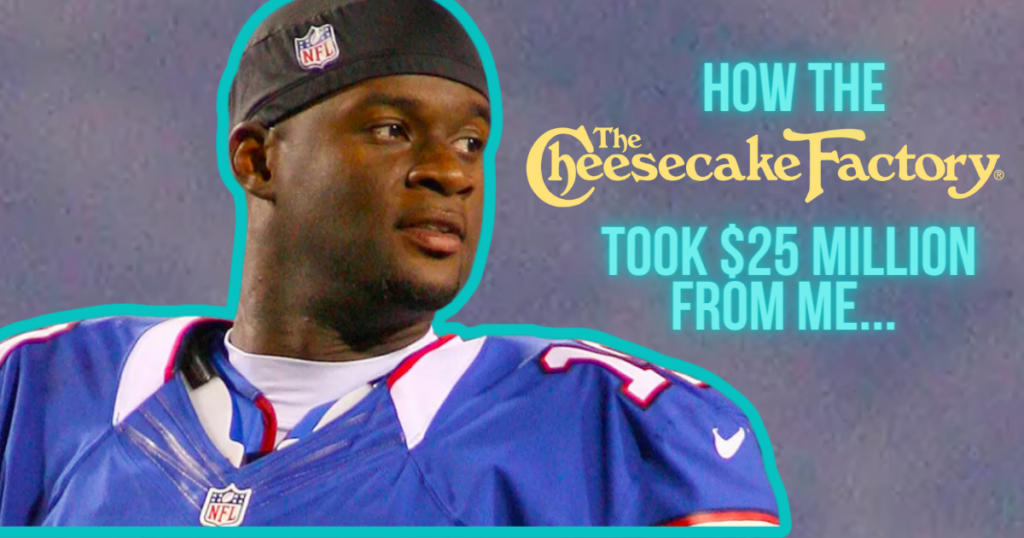

NFL all-star Vince Young learned this the hard way when he found out his financial advisor had stolen about $5.5 million from him. When a player joins the league, they typically do so in their first year of college. They enter the league excited to finally be rewarded for dedicating decades of their childhood to this sport. They have an electrifying and amazing rookie season, and the whole world now has their eye on that player… including potential financial advisors who may not have their best interests in mind.

This is why it’s important to check your statements, transactions, and have a monthly spending goal so that you know when things don’t look right in your banking transactions. Additionally, research the advisor’s background and check with your gut to see how you feel about this person even if they do seem professional and come highly recommended.

Mistake #2: Ignoring Your Money Mindset

Over $35 million of Vince Young’s hard-earned money playing for the Titans, Philadelphia Eagles, Buffalo Bills, and Green Bay Packers… Gone! Maybe spending $5,000 a week at the Cheesecake Factory wasn’t such a good idea? Player Andre Rison blew $19 million, most of which was on luxury vehicles, and even admitted to spending over $1 million on jewelry alone.1

“There’s so much in your subconscious that can lead you to act in the craziest ways when it comes to money. We self-sabotage and don’t even know we’re doing it,” says money mindset guru, Scarlette Joyce Rojas. Terrell Owens met the same fate and squandered the $80 million he had made in his career. 2Enjoying a flashy lifestyle to showcase your success can be seen as “normal” in this world of superstardom, but money mindset guru and financial advisor, Scarlette Joyce Rojas, points to another reason these NFL players burn through their money. “Many pro players come from low to mid-income families where they never got the luxuries they now have access to, so there’s a voice inside them that says ‘I deserve this,’ even if it means blowing through all their money! That’s their subconscious way of trying to heal their inner child – the one who never got what he wanted in the past.”

But it doesn’t have to be this way! Aaron Rodgers, who also grew up in a low-income family, handles his money intelligently. With multiple business ventures, like part ownership of the Milwaukee Bucks, investing in Core Power Yoga, and even in football helmets, Aaron is setting himself up for a successful future beyond football and Super Bowl season.

Mistake #3: Relying on One Source of Income

When you’re making a lot of money, it’s easy to fall into the trap of thinking it’ll always be there, but that’s not the case, especially when your body calls the shots – one wrong hit and you’re down for the season or your entire career. Relying solely on NFL paychecks is a mistake, especially when the average retirement age in this career is at the early age of 40. Having other sources of income is crucial to your success, and the highest-paid NFL players do this via endorsement deals. Peyton Manning, Drew Brees, Eli Manning, and Aaron Rodgers are some of the top NFL off-field earners.3 But you don’t have to be an NFL player to practice this strategy. If you have a 9 to 5 job, do you have another source of income like a rental property, side hustle, YouTube channel that can be monetized, or stocks with a growth strategy or dividend income? Get creative, and bring in other sources of income because putting all your eggs in one basket is a recipe for madness.

*

*

* The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. To determine which strategies or investments may be suitable for you, consult the appropriate qualified professional prior to making a decision. Investing includes risks, including fluctuating prices and loss of principal. No strategy assures success or protects against loss.

- Reporter, D. M. (2013, October 22). Former NFL star reveals how he is broke after wasting $1m on jewelry and three cars in one season (so it probably didn’t help that his ex lisa “left eye” Lopes burnt his mansion down). Daily Mail Online. https://www.dailymail.co.uk/news/article-2471591/BrokeAndre-Rison-Ex-NFL-star-reveals-wasted-1m-jewelry-bought-cars.html ↩︎

- Yahoo! (n.d.). Terrell Owens earned an estimated $80m in the NFL but admits he lost it after letting people control his finances – “they just basically stole from me.” Yahoo! Finance. https://finance.yahoo.com/news/terrell-owens-earned-estimated-80m-181207295.html?guccounter=1&guce_referrer=aHR0cHM6Ly93d3cuZ29vZ2xlLmNvbS8&guce_referrer_sig=AQAAAFeNxxECS5W2mC5cES7WJ-GY5p2AsZ6HinhhNRGuBZvYH4PQwrrl4dwv71tBfezMtNBQH62soHycOv-ckGIcajNNYskV_0-p0E7PjGm923SIKeoHuC57SGyhcbafKxYPVKD05KEi_Z163DKWN9whORukaDwzI0kkrxL3sPDCtFwr ↩︎

- Nfl. (2015, October 12). The top 9 NFL players’ off-field earnings. NFL.com. https://www.nfl.com/photos/the-top-9-nfl-players-off-field-earnings-0ap3000000555898 ↩︎